| |

|

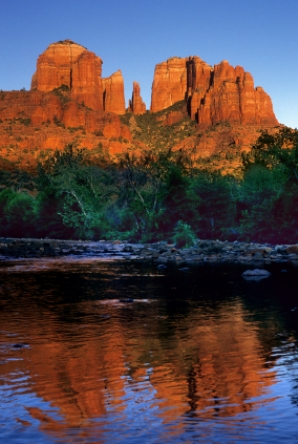

Oak Creek and Red Rock,

Oak Creek and Red Rock,

Reflections of the Red Rocks at sunset

Our forms are in Adobe Acrobat (pdf) format. You will need Adobe Acrobat Reader

installed on your computer to view and print these forms. Click the Adobe logo to download

a free version of Adobe Acrobat Reader.

Some forms allow you to fill them out on-screen and print them, however, you cannot save

them. It will be necessary to fill the form out each time it is opened.

|

|

These are frequently asked questions about CPA Firms: |

|

| |

What is the definition of Accounting Services?

What is the definition of Attest Services and Compilation Services?

Do I need to be registered as a firm?

What are the steps in the application process?

After I’m registered, are there any ongoing notification requirements?

How are Arizona CPA firms impacted by peer review?

What is Facilitated State Board Access?

What should be considered when naming my firm?

How do I change the name of my firm?

What happens if a partner leaves? Do we have to change the firm name?

How often does my firm's registration renew?

How much does it cost to renew my firm's registration?

How do I cancel my firm’s registration?

My firm’s registration is currently suspended, can I provide attest services or compilation services?

Do I have the option to relinquish my firm registration?

Can I reinstate my firm’s registration if it has been cancelled, expired, relinquished or revoked?

How do I request verification of my firm registration?

|

|

| |

|

|

What is the definition of Accounting Services?

|

|

| |

Accounting Services means services that are commonly and historically performed by accountants, including recording or summarizing financial transactions,

bookkeeping, analyzing or verifying financial information, reporting financial results, financial planning, or providing attest services,

compilation services, tax services or consulting services.

|

| |

|

|

What is the definition of Attest Services and Compilation Services?

|

|

| |

Attest Services means the following services to be performed by the holder of a certificate issued by the board:

-

Audits or other engagements to be performed in accordance with the Statements on Auditing standards adopted

by the American Institute of Certified Public Accountants (AICPA).

-

Reviews of financial statements to be performed in accordance with the Statements on Standards for Accounting

and Review services adopted by the AICPA.

-

Any examination of prospective financial information to be performed in accordance with the Statements on

standards for Attestation Engagements adopted by the AICPA.

-

Any engagement to be performed in accordance with the Standards of the Public Company Accounting Oversight

Board or its successor.

-

Any examination, review or agreed on procedure engagement to be performed in accordance with the statements on

Standards for Attestation engagements adopted by the AICPA, other than an examination described in subdivision (c)

of this paragraph.

Compilation Services means:

Providing a service of any compilation engagement to be performed in accordance with the Statements on Standards for

Accounting and Review Services.

|

top |

|

Do I need to be registered as a firm?

|

|

| |

Pursuant to A.R.S. § 32-731, the following must register with the Board as a CPA firm:

-

Partnership, PC, PLLC, LLC, or LLP that meets all of the following criteria:

-

Has a simple majority of the ownership, in terms of direct and indirect financial interests and voting rights,

that belong to holders in good standing1/ of certificates or licenses as CPAs in any jurisdiction2/.

-

Has an office in this state.

-

Either:

-

Performs attest services or compilation services; or

-

Uses the CPA designation in its business name.

-

Sole Proprietorship3/ that meets all of the following criteria:

-

Has an owner that is a CPA in good standing in this state.

-

Has an office in this state.

-

Either:

-

Performs attest services or compilation services.

-

Uses the CPA designation in its business name, unless the business name is the name of the sole proprietorship

as registered with the Board.

-

An individual that meets all of the following criteria:

-

Is a CPA in good standing in this state.

-

Either:

-

Performs attest services or compilation services in this state, other than as an owner or employee of a sole proprietorship

or business organization required to register as described above or in the capacity as an employee of a governmental entity.

-

Uses the CPA designation, unless the name used is the name of the individual as registered with the Board.

Once registered with the Board as a CPA firm, you need to maintain the above-applicable requirements in order to operate as a CPA firm.

Failure to do so may result in revocation of the CPA firm’s registration, pursuant to A.R.S. § 32-730.03(A)(4), unless granted an extension of

time to comply with firm registration requirements pursuant to A.R.S. § 32-731(F).

1/ “Good Standing” means for an individual, a status that allows the individual to use the CPA designation and to perform

accounting services for a fee or other compensation; which, in Arizona, means “Active” or “Probation,” but which may be a different

status in another jurisdiction.

2/ “Jurisdiction” means the 50 states of the United States, District of Columbia, U.S. Virgin Islands, Guam, the Commonwealth of the

Northern Mariana Islands or Puerto Rico.

3/ “Sole Proprietorship” means a business that is owned by one individual and that does not have a legal distinction between

the owner and the business.

Helpful Hints – CPA Designation in Firm Name

Helpful Hints – CPA Designation in Firm Name

If the CPA designation is used in the business name as any of the following:

-

As trademarked with the Secretary of State (sole proprietors/individuals)

-

As organized or incorporated with the Arizona Corporation Commission (partnership, PC, PLLC, LLC, or LLP)

-

As certified or registered with the Arizona State Board of Accountancy (sole proprietors/individuals/partnership, PC, PLLC, LLC, or LLP)

You must apply for or renew an existing firm. If you do not want to register a firm, due to the use of the CPA designation,

you may do one of the following:

Partnership, PC, PLLC, LLC, or LLP

-

Change your business name to exclude the CPA designation, and if currently registered as a firm, submit a cancelation order with the Board.

Sole Proprietors or Individuals

-

Submit a name change with the Board to amend your name as certified by and registered with the Board to exactly match your business name.

-

Change your business name to exactly match your name as certified by and registered with the Board, and if currently registered

as a firm, submit a name change form with the Board.

The following FAQs may be helpful.

What should be considered when naming my firm?

How do I change the name of my firm?

|

top

|

|

What are the steps in the application process?

|

|

| |

-

Submit application materials

Helpful Hints - There is no application fee for new firm applications or firm reinstatement applications.

Helpful Hints - There is no application fee for new firm applications or firm reinstatement applications.

-

Staff Review

Pursuant to A.A.C. R4-1-341(C)(2), within 10 days of receiving an application

packet, the Board shall notify the applicant that the application is complete.

If the application is incomplete, an incomplete notice shall be sent to the

applicant that specifies what information is missing. The applicant has 30 days

from the incomplete letter to respond in writing and provide all the missing

information or the Board may administratively close the file.

-

Executive Director/Board Review

Pursuant to A.R.S. § 32-703(B)(14), the Board may delegate to the Executive

Director the authority to approve an application for firm registration. If the

application is complete and the applicant meets firm registration requirements,

it will be approved by the Executive Director and the applicant will be

notified of the approval by U.S. mail. If the application is complete but

applicant does not meet appropriate requirements, the application will go

before the Board to review and make a final determination. The Board generally

meets monthly, except for April and October (see the calendar for dates).

-

Payment of Registration Fee

Upon approval of the application, the Board will send a letter requesting the

biennial registration fee of $300 which is due within 30 days of the date of the

letter or the firm will be automatically-suspended without prior notice or a

hearing, pursuant to A.R.S. § 32-741.01

|

top |

|

After I’m registered, are there any ongoing notification requirements?

|

|

| |

Yes, pursuant to A.R.S. §32-731(E), you are required to notify the Board in writing within one month of any change in owners that results in less than a simple majority

of the ownership in terms of direct and indirect financial interests and voting rights that belong to holders in good standing of certificates or licenses as certified

public accountants in any jurisdiction.

|

top |

|

How are Arizona CPA firms impacted by peer review?

|

|

| |

Pursuant to A.A.C. R4-1-454(A), firms shall comply with the Standards for Performing and Reporting on

Peer Reviews (Peer Review Standards), which are incorporated by reference. Pursuant to the Peer Review

Standards, firms that perform attest services or compilation services are required to undergo and

complete a peer review. For a further review of the regulation governing peer review, please see the

Peer Review page under the Firms tab on this website.

Helpful Hints - The Peer Review process is often more extensive and expensive to complete than

a registrant may realize. It is recommended that a registrant not perform attest services or compilation services that would

subject the firm to peer review without first inquiring with the California Society of CPAs

(CalCPA) Peer Review program to better understand the full process.

Helpful Hints - The Peer Review process is often more extensive and expensive to complete than

a registrant may realize. It is recommended that a registrant not perform attest services or compilation services that would

subject the firm to peer review without first inquiring with the California Society of CPAs

(CalCPA) Peer Review program to better understand the full process.

|

|

What is Facilitated State Board Access?

|

|

| |

The Facilitated State Board Access (FSBA) is a process that addresses the demand for greater peer review

transparency. This is a program that the American Institute of Certified Public Accountants (AICPA)

created to help the profession keep up with the evolving changes in the business and regulatory

environments.

Per A.A.C. R4-1-454(B), firms must allow the sponsoring organization (California Society of CPAs) to make

peer review documents accessible to the Board via the FSBA process.

|

top |

|

What should be considered when naming my firm?

|

|

| |

The Board has a statute and rule that addresses firm name issues:

-

A.R.S § 32-731(I) states that a registrant, which means any CPA or CPA firm registered with the Board, may not use any firm name other than the firm name that is registered with the Board.

-

A.A.C. R4-1-455.03(C) provides that a registrant shall not use a professional or firm name or designation that is misleading about the legal form of

the firm, or about the persons who are partners, officers, members, managers, or shareholders of the

firm, or about any other matter. A firm name or designation shall not include words such as “&

Company,” “& Associates,” or “& Consultants” unless the terms refer to additional full‐time CPAs that are

not otherwise mentioned in the firm name. (See examples of possible misleading firm names below.)

Examples of firm names that would be considered misleading include, but are not limited to, the following:

-

The CPA firm name includes the plural form of the CPA designation, when only one owner in the firm is a CPA.

-

The CPA firm name includes the name of a non-CPA owner of the firm.

-

The firm name includes the use of “& Company,” “& Associates,” “& Consultants,” “Group,” or other similar descriptor,

when the firm does not have at least two CPA owners not already named in the firm name, or two additional CPA employees

with the firm, in addition all named owners.

-

The CPA firm name implies the existence of a legal business entity when the firm is not organized or incorporated

with the Arizona Corporation Commission as such (e.g., the use of P.C., PLLC, LLC, or LLP).

-

The CPA firm name implies certain favorable results can be achieved or creates unjustified expectations

(e.g., Arizona’s Best Accounting Firm Ever, PLLC).

-

The CPA firm uses a doing-business-as name (e.g. CPA firm uses the firm name “Smith Financial” when it is registered

with the Board as “John Smith, CPA, PLLC”.)

Please see the following statute to learn more about the naming requirements for a domestic

professional corporation or a foreign professional corporation:

|

| |

|

| |

Please see the following statutes to learn more about the naming requirements for limited liability

companies, professional limited liability companies, and limited liability partnerships composed of

certified public accountants:

|

| |

|

top |

|

How do I change the name of my firm?

|

|

| |

If you own a firm, changes to the firm’s name require the Board's Executive Director's

approval and can be submitted for review using the

Firm Name Change Application Form.

Please see A.R.S. § 32-731(I) and A.A.C. R4-1-455.03(C) for more information about

form of practice and name changes.

Helpful Hints – A.R.S. § 32-731(I) – A registrant, which means any CPA or CPA firm registered with the Board, may not use any firm name

other than the firm name that is registered with the Board.

Helpful Hints – A.R.S. § 32-731(I) – A registrant, which means any CPA or CPA firm registered with the Board, may not use any firm name

other than the firm name that is registered with the Board.

Helpful Hints - A.A.C R4-1-455.03(C) - A registrant shall not use a professional or firm name or designation that is misleading about the legal

form of the firm, or about the persons who are partners, officers, members, managers, or shareholders of

the firm, or about any other matter. A firm name or designation shall not include words such as “&

Company,” “& Associates,” or “& Consultants” unless the terms refer to additional full‐time CPAs that are

not otherwise mentioned in the firm name.

Helpful Hints - A.A.C R4-1-455.03(C) - A registrant shall not use a professional or firm name or designation that is misleading about the legal

form of the firm, or about the persons who are partners, officers, members, managers, or shareholders of

the firm, or about any other matter. A firm name or designation shall not include words such as “&

Company,” “& Associates,” or “& Consultants” unless the terms refer to additional full‐time CPAs that are

not otherwise mentioned in the firm name.

|

top |

|

What happens if a partner leaves? Do we have to change the firm name?

|

|

| |

Should the firm lose a partner, the firm is not required to change the firm name, pursuant to A.R.S. § 32-

747(C). The law provides the right to the continuous use of a partnership name, or a modification of the name, by

successor firms formed by the remaining partner(s) or added partner(s) even though the individuals

whose names are included in the firm name are not partners.

|

top |

|

How often does my firm's registration renew?

|

|

| |

Pursuant to A.R.S. § 32-730, the Board requires every CPA firm to renew its registration on a biennial

basis. However, the timing of the registration depends on whether the firm is:

|

| |

|

|

1)

|

|

A “business organization” which means a partnership, professional corporation (PC),

professional limited liability company (PLLC), limited liability company (LLC) or

limited liability partnership or any other entity that is recognized by the Board

and that is establish under the laws of any state or foreign country.

|

|

|

2)

|

|

A “sole proprietorship” which means a business that is owned by one individual and that does not

have a legal distinction between the owner and the business.

|

|

|

3)

|

|

An “individual” which means a CPA that IS NOT an owner or employee of a business organization

or sole proprietorship or an employee of a governmental entity.

|

|

| |

A business organization shall renew during the board-approved month in either an even or odd numbered year,

depending on whether the firm registration was initially board-approved in an even- numbered or an

odd-numbered year.

|

| |

A sole proprietorship or individual shall renew during his/her birth month in either an even or odd numbered year,

depending on whether the year of their birth is an even or odd numbered year

|

top |

|

How much does it cost to renew my firm's registration?

|

|

| |

Pursuant to A.A.C. R4-1-345(C)(2)(b), the biennial registration fee for each CPA firm is $300 per registration

period. A late fee of $50 will be assessed if the firm's renewal is not received on time. However, pursuant

to A.R.S. §32-729, a registration fee is not charged for the registration of additional offices of the same

firm or for the registration of a sole proprietorship1/ or an individual2/ who is required to register as a firm

pursuant to A.R.S. § 32-731 (see FAQ question: “Do I need to be registered as a firm?”).

|

| |

1/A “sole proprietorship” means a business that is owned by one individual and that does not have a legal

distinction between the owner and the business. A “sole proprietor” means the owner of a sole proprietorship.

2/An “individual” means a CPA that IS NOT an owner or employee of a business organization or sole proprietorship

or an employee of a governmental entity.

|

top

|

|

How do I cancel my firm’s registration?

|

|

| |

Please select this link to learn more

|

top |

|

My firm’s registration is currently suspended, can I provide attest services or compilation services?

|

|

| |

Pursuant to A.R.S. § 32-731(B), attest services or compilation services shall be provided only through a registered firm in

good standing in this state. Any attest services or compilation services reports issued by a firm must be signed by a person

who is certified pursuant to this chapter or qualified to exercise the limited reciprocity privilege pursuant to

A.R.S. § 32-725(G).

Helpful Hints – A.R.S. § 32-731(J)(2) – For a firm, “Good Standing” means a status that allows the firm

to use the CPA designation. Therefore, a status such as “suspended”, which disallow the firm from using

the CPA designation, would further prohibit the firm from providing attest services or compilation services while suspended.

Helpful Hints – A.R.S. § 32-731(J)(2) – For a firm, “Good Standing” means a status that allows the firm

to use the CPA designation. Therefore, a status such as “suspended”, which disallow the firm from using

the CPA designation, would further prohibit the firm from providing attest services or compilation services while suspended.

|

top |

|

Do I have the option to relinquish my firm registration?

|

|

| |

A.R.S. § 32-730.06(A) allows a firm to relinquish its registration pending or in lieu of an investigation

or a disciplinary proceeding or while under a disciplinary order. The Board shall consider a

relinquishment and may determine whether to accept the relinquishment and if accepted shall issue an

order documenting its decision.

|

top |

|

Can I reinstate my firm’s registration if it has been cancelled, expired, relinquished or revoked?

|

|

| |

Firm registrations can be reinstated from cancelled, expired, relinquished, or revoked status pursuant to A.R.S. § 32-732.

Cancelled Firms: Pursuant to A.R.S. § 32-732(E), an individual, sole proprietor or business organization whose firm registration

has been cancelled may request that the firm registration be reinstated if the individual, sole proprietor or business organization

does all of the following:

-

Files an application for reinstatement on the form prescribed by the Board and pays the reinstatement application fee

pursuant to A.R.S. § 32-729.

-

Meets the requirements of A.R.S. § 32-731.

-

On Board approval of reinstatement, pays the registration fee pursuant to A.R.S. § 32-729.

Expired, Relinquished, or Revoked Firms: Pursuant to A.R.S. § 32-732(F), an individual, sole proprietor or business

organization whose firm registration has expired or been relinquished or revoked may request that the firm registration

be reinstated if the individual, sole proprietor or business organization meets all of the following requirements:

-

Files an application for reinstatement on the form prescribed by the Board and pays the reinstatement

application fee pursuant to A.R.S. § 32-729.

-

Meets the requirements of A.R.S. § 32-731.

-

On Board approval of reinstatement, pays the registration fee pursuant to A.R.S. § 32-729.

-

Demonstrates through substantial evidence presented to the Board that the firm is completely rehabilitated with

respect to the conduct that was pending or outstanding at the time the registration was relinquished or revoked

or that occurred before or after the registration expired. Demonstration of rehabilitation includes evidence of

the following:

-

The firm or any owner of the firm has not engaged in any conduct that, if the firm had been registered

during the period the conduct occurred, would have constituted a basis for revocation or suspension

pursuant to A.R.S. § 32-741.

-

The firm has addressed or remediated any complaints, investigations or board-ordered requirements that

were pending or outstanding at the time of expiration, relinquishment or revocation.

-

The firm has made restitution as ordered by the Board or by a court of competent jurisdiction as a result

of any violation of this chapter or rules adopted pursuant to this chapter.

-

Other evidence of rehabilitation that the Board deems appropriate.

|

top |

|

How do I request verification of my firm registration?

|

|

| |

For your convenience, use the form below when requesting verification of your firm registration.

There is no fee associated with a request verification.

Verification Form of Uniform CPA Exam/CPA Certificate/Firm Registration

|

top |

| |

|